Amanzhayev D. G.

Institute of Management and Finance at

Kyiv National Taras Shevchenko University,

graduate

student of "Finance and Credit"

Principles

of Mortgage Lending

Mortgage loan -

this is the same bank (credit) mortgage, you need to consider more money for

the relationship, not about real estate. This residential mortgage - a mortgage

loan issued for the purposes of purchase, construction or upgrade (repair) of

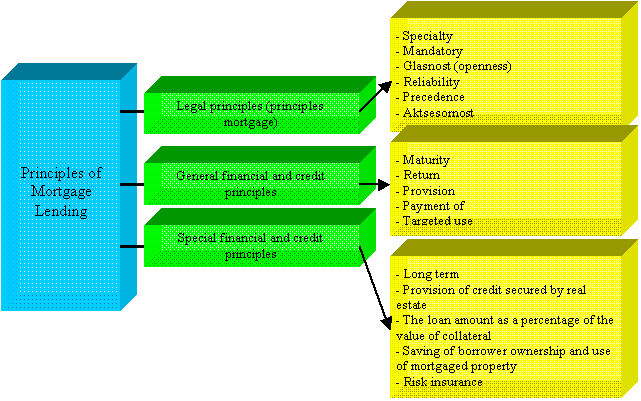

residential real estate destination. Relations in mortgage lending based on the

principles that share the general characteristic of all forms of loan

(maturity, return, payment, security, purpose), and special inherent in the

mortgage loan as a special category (Fig. 1).

The special principles mortgage O.

Lavrushyn include the following [2, p. 45]:

- provision of

credit secured by real estate;

- determination of

the loan as part of the value of mortgaged real estate;

- saving of

borrower ownership and use of mortgaged real estate;

- insurance risk

mortgage lending.

Thus, the general and special

principles are the people – fundamental mortgage features, regarded as its

essential features, since in the absence of at least one of them a mortgage

loan as a separate economic category ceases to exist.

Specific mortgage credit relations creates

certain advantages secured by the real estate lending are both borrower and lender for. The main

advantage of mortgage for borrowers is a growth investment opportunities by

converting real estate on operating capital, functioning

of the mortgaged property for its intended purpose, stability in nominal

terms throughout the period of the loan, reducing the amount of monthly,

quarterly, annual payment through long-term mortgage credit.

For lender

mortgages are attractive because of stable income, relatively low risk for

loans secured by real estate, providing a stable customer base and long-term

cooperation. Given the economic importance of mortgage O.

Evtukh offers complete classification principles mortgage principle of

sociality and yield [1, p. 51].

Fig. 1.

The principles of mortgage lending [48, p. 20]

Mortgage

loans sold during the agreement on a mortgage loan subject to the requirements

established by law. Creditor to contract for a mortgage loan shall

disclose the basic economic and legal requirements for a loan.

So, analysis of

scientific literature on the definitions the term "mortgage" allows

us to give a modern definition of "mortgage" as an economic and legal

institution [3, c. p. 14]. Mortgage can be defined as both of connected to

each other category. First, a monetary obligation secured by collateral real

estate, land, certain items of movable property, property rights, issuing

mortgage securities and other mortgage debt. Second, this collateral. Thirdly,

a mortgage loan.

List of sources:

1. Євтух О. Житлова

іпотека: фінансово-економічний аспект // Вісник НБУ. – 2000. – №4. – с. 51-52.

2. Лаврушин О. И. Банковское

дело: современная система кредитования : учеб. пособие для студ., обуч. по

спец. "Финансы и кредит" / О. И. Лаврушин [и др.] ; Финансовая академия при Правительстве

Российской Федерации. - М. : Кнорус, 2007. - 260 с.

3. Susan Hudson-Wilson. Modern

real estate portfolio management. – NY: Frank J. Fabozzi Associates New Hope,

Pensylvania, 2000, 239 p.