Економічні науки/3. Фінансові відносини

Lelyuk S.V.

Simon Kuznets Kharkiv National University of Economics

The

cluster analysis as a stage of strategic monitoring of business entities’

financial safety

A

large number of threats formed under the influence of external and internal

factors of business entity’s functioning. These threats disturb strategic

guidelines of sustainable development of business entities, change its environment in general, and its existence

in particular, create problematic aspects to ensure the financial safety.

Timely identification and prediction of internal and external threatening

factors of the financial safety for operational and preventive management

decisions can be provided by strategic monitoring, which is a relations management

system with an environment of the enterprise [3], an instrument of control adopted plans and programs of

business entity, a tool to form an information base for their development.

The

experience of financial safety assessment accumulated in the works of O. Arefieva, I. Blank, K. Horiacheva, M. Yermoshenko,

Yu. Kim, T. Kuzenko, V. Orlova, R. Papiekhin, L. Petrenko,

O. Plastun, M. Pohosova etc. The most significant works devoted to

the essence of strategic monitoring are written by Ye. Atamas,

A. Herasymova, Yu. Matskevyc, L. Pan, I. Protsiuk,

N. Romanchenko etc. At the same time, the issues of enterprise’ strategic

monitoring organization as a whole and the use of tools of cluster analysis as

its stage in particular have not been covered.

Strategic

monitoring is a source of complete and timely information, and thus has an

impact on the effectiveness of decision-making.

Management of financial safety is provided by the

decision-making in the financial sector of enterprise [1]. Therefore a strategic monitoring provides an objective assessment of

the financial condition of business entity. Strategic

monitoring is the target subsystem of strategic management of coordination type

[4]. Full set of strategic monitoring’s related functions as observation, assessment,

analysis, planning and forecasting realized in the course of its implementation.

Thus, the whole set of the determining factors that have an impact on financial

safety management is covered.

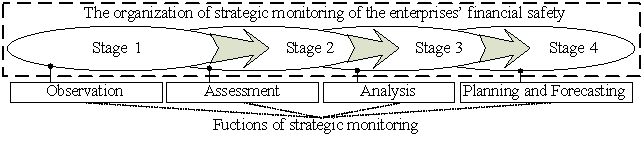

Functionality

of strategic monitoring generates the appropriate sequence of steps for the

implementation of its properties. Therefore, it is advisable to distinguish the

following stages for organization of the strategic monitoring of enterprises’

financial safety, which reflect function (fig. 1).

Figure 1.

The organization of strategic monitoring of the enterprises’ financial safety

(compiled by the author)

Stage 1.

Observations of the business entities’ financial safety.

Stage 2.

Assessment of financial safety of business entities.

Stage 3. Analysis

of factors that affect the level of financial safety of business entities.

Stage 4. Planning

and forecasting of business entities’ financial safety influenced by factors

external and internal environment.

Thus, we proposed

to group companies for level of financial safety, under implementation analysis

function of the factors affecting its. Classifications of business entities

allow allocate groups with common characteristics of development and the

factors that shape it. Identification of the aforementioned groups is expected to

produce on the basis of the use of cluster analysis procedures.

Formation of

groups of similar objects, which are characterized by certain features is one

of the tasks of cluster analysis [2]. As mentioned features is proposed to

consider partial indicators of business entities’ financial safety, calculated

at second stage of strategic monitoring. Using of hierarchical clustering

methods become necessary for the classification of enterprises taking into

account the attributes that match the values of partial indicators of financial

safety. Hierarchical clustering methods can determine the possible number of

clusters and the distance at which they are formed. After verification of the

hypothesis about the presence of possible number of clusters business entities

by level financial safety the next step will be to use iterative clustering

procedures which include k-means method. This method involves partitioning the

input set of objects under study in a number of clusters, which has been

identified as a result of the hierarchical agglomerative methods

All of the

above demonstrates that further exploration of research will focus on empirical

studies of business entities clustering by level of financial safety and in

particular and appointed steps of strategic monitoring in general.

References:

1. Бланк И.А. Управление финансовой безопасностью

предприятия / И.А. Бланк. – Киев: Эльга, Ника-Центр, 2004. – 748 с.

2. Многомерный статистический анализ в экономике : [учебн.

пособие для вузов] / Л.А. Сошникова, В.Н. Томашевич, Г. Уебе, М. Шефер; Под ред

В.Н. Томашевича. – М.: ЮНИТИ-ДАНА, 1999. – 598 с.

3. Пан Л. В. Стратегічний моніторинг як підсистема

стратегічного управління підприємством / Пан Л. В., Романченко Н. В. //

Управління проектами, системний аналіз і логістика. - 2008. - № 5. - С.

357-358.

4. Ратушний Ю.В. Формування системи стратегічного

моніторингу середовища функціонування організації (на матеріалах

гірничо-збагачувальних підприємств Кривбасу) : автореф. дис.. к.е.н. за спец.

08.06.01 «Економіка, організація і управління підприємствами» / Ю.В. Ратушний.

– Київ, 2003. – 21 с.