Interrelation of tax incentives and the tax potential

This article describes the tax incentives and tax potential Stimulation

of investments through fiscal instruments (tax incentives and preferences)

during the modernization of the economy has become an urgent necessity. It is

necessary to take into account the fact that the tax incentives can reduce the

tax potential. The effect of tax incentives for tax potential can be ambiguous.

For this reason, the government must correctly relate these two categories in

the process of alignment of intergovernmental fiscal relations and the level of

the region's development in the country.

Availability of tax incentives aimed at solving specific problems, and,

above all, is to support the socially vulnerable segments of the population,

stimulation of certain types of economic activity (agriculture, small

business), scope (innovative technologies, charity, philanthropy, etc.) [1].

Regarding the latter reason one can add that it is necessary to develop

and maintain an adequate level of tax incentives in the economy due to the fact

that the implementation of innovative enterprises need free financial resources

that can be released in case of reducing the tax burden [2].

Having noted the need to implement tax incentives, will focus on the

consideration of the concept of «tax incentives».

Tax incentives are a purposeful activity of public authorities and local

self-government for the establishment of tax incentives and other measures of a

tax nature of tax legislation, improving the property or the economic situation

of certain categories of taxpayers [3].

Tax stimulation is carried out through a cost-based system of incentives.

It is a cohesive package of tax incentives and strategic preferences, which is

compensating funds invested in the production of new competitive products, the

modernization of technical processes, to strengthen the foundations of

entrepreneurship and business [4].

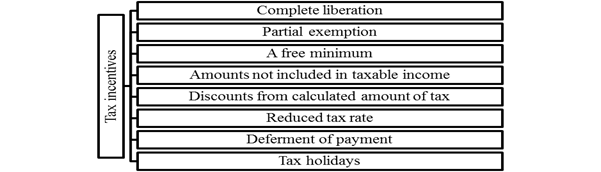

Tax incentives are presented in Figure 1. They themselves will never be

effective in the absence of other systemic mechanisms of protection and support

taxpayers from the government (stability, certainty of tax legislation, the tax

burden is feasible within the general tax regime, the legitimacy of the tax

authorities of the state, fair penalties for tax evasion, etc.).

Figure 1. Types of tax incentives - tax incentive instruments [5].

Therefore, the use of tax incentives as from the government, and by the

taxpayers should be initially valid, comprehensive and thoughtful [6].

In addition to tax incentives, tax preferences may also be a tax

stimulation tool. One will consider the following concepts to get an

idea about the investment tax preferences:

‒

Definition;

‒

Subjects and

objects of investment preferences.

The definition of investment tax preferences could include - a benefit

that provides exemption from CIT and lies in the fact that the value of tax

preferences objects and/or follow-up costs for modernization and reconstruction

are deductible.

Since 2009, the procedure for obtaining tax preferences has been

simplified. If earlier for tax preferences should conclude a contract by the

Investment Committee, now the taxpayer can apply on their own preferences to

obtain prior permission unless necessary. The right to apply the investment tax

preferences belongs only to legal entities, except those that meet at least one

of the following conditions:

‒

Enterprises

operate within the territories of special economic zones (these taxpayers have

the right to reduce the amount of CIT payable at 100%, and they applied the

coefficient of 0 in the relevant interest rates and the average annual value of

objects of taxation on land and property taxes);

‒

Enterprises are

involved in production and / or sale of excisable goods (alcohol, alcoholic

beverages, and tobacco products). The preferences are aimed at the development

of the productive sector of the economy, which in turn is intended to lead to

the improvement of the economic and physical well-being of citizens;

‒

The taxpayer

applies the special tax regime for legal entities - producers of agricultural

products, fishery products and rural consumer cooperatives. This category of

taxpayers applies a special category of CIT incentives, VAT, social tax, land

tax, payment for use of land plots, property tax, tax on vehicles (calculated

in accordance with the established order of the taxes and fees are subject to

reduction by 70%).

The objects of preferences are first put into service in the territory

of the Republic of Kazakhstan buildings and facilities for production purposes,

machinery and equipment, which for at least three tax periods following the tax

period of commissioning, at the same time meet the following conditions:

‒

Recognized as

fixed assets in the accounting records of the taxpayer;

‒

Used by the

taxpayer in activities aimed at generating income;

‒

Not used in the

activities under the subsoil use contract [5].

In addition to the positive effect of the tax stimulation with the help

of tax incentives and preferences, it negatively affects the tax potential.

Tax potential - a potential budget income per capita or resources of the

region budget revenues, which can be obtained by the authorities for a certain

period when used in the country of the same tax conditions [7].

Inclusion in the tax potential

of taxable resources of the region can be represented by two variants:

‒

Are considered only resources to be currently taxable on a statutory basis;

‒

In addition to the above-mentioned resources, there are considered not

involved taxable resources, i.e. objects of the shadow economy, which are required

legalization in accordance with the law.

The first option is more negative impact on the political, economic and

social stakeholders' livelihoods, but in theory can solve some short-term,

current problems. The second option gives you the ability to achieve the

'software', long-term goals. This separation creates a new factor allowing

allocating "tax potential" subcategories, namely, the time factor,

which is expressed in the short and / or long term.

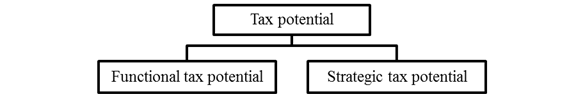

Figure 2. Sub categories of the tax potential, according to the time

factor [8].

The functional capacity of the tax is not taxable or partly taxable

entities that are able to quickly join in the taxation process and do not

require a fundamental change in the legislation. In turn, strategic - entities

that operate outside the law on taxation in connection with the implementation

of informal or illegal activities. Such tax potential requires the creation and

implementation of new or change old laws, as well as improving the future tax

revenues, which will be used for the implementation of any projects and

programs [8].

Tax incentives and tax potential categories are interrelated, because

both belong to the constituent elements of the tax system of the country. The

use of tax incentives in the short term negative impact on potential tax due to

the fact that the taxpayers will be partially or fully exempt from tax and thus

revenue decrease, which will reduce the tax potential of the region. On the

other hand, in the long term, there will be a reverse trend. This is due to the

fact that the tax incentive period is completed, and taxpayers, by improving

their financial situation will pay taxes in the budget in standard mode and

high volume, as their incomes rose.

Summarizing all above-mentioned one could derive that the use of tax

incentives might affect the tax potential, giving the government another tool

to align the intergovernmental fiscal relations and the level of development of

the regions in the country.

References:

1. Ermekbaeva BJ, Abisheva

K. Effect on tax benefits of economic activity in the Republic of Kazakhstan //

Herald TREASURY Series Economical. – 2015, ¹1 (107). – p.414-418.

2. Timchenko EY Promoting economic development

methods of tax regulation // scientific and educational space: prospects:

Proceedings of the II International. Scientific-practical. Conf. - Cheboksary:

CNS "Interactive plus." – 2016. – p.421-426.

3. Vasiliev SV Legal means of tax incentives

for innovation. Dis. on soisk. Ouch. Art. Ph.D.

12.00.14. - Moscow. – 2009. – p.70.

4. Kireeva EF Tax incentives for innovation as

a factor in the stabilization of the economy of the Republic of Belarus //

development of economic cooperation between the Republic of Belarus and the

Republic of Moldova in the international economy: Proceedings of the II

International scientific-practical conference - Minsk: Belarusian State

Economic University – 2010. – p.68-73.

5. The Tax Code of the Republic of Kazakhstan dated December 10, 2008 ¹

99-IV (as amended as of 01/01/2017 was). – Almaty: Lawyer. – 2017. - p.436.

6. Ermekbaeva BJ Problems of improving the use

of tax incentive mechanism // Herald TREASURY Series Economical. – 2016, ¹1

(113). – p.110-115.

7. Lemeshko NS Comparative characteristics of

the tax capacity estimation techniques regions // Economics. – 2012, ¹ 7. –

p.61-63.

8. Simonov Yu Tax potential // Young scientist. – 2014, ¹1. – p.423-425.