Khodova

A.A., Yerysh L.A.

Donetsk

national university of economics and trade

named after

M. Tugan-Baranovsky

PRINCIPLES

AND STEPS OF RISK-MANAGEMENT

A

substantial body of knowledge has developed around risk management.

In general, risk management includes development of a risk management

approach and plan, identification of components of the risk management

process, and guidance on activities, effective practices, and tools for

executing each component.

Risk

management is the identification, assessment, and prioritization of risks followed by

coordinated and economical application of resources to minimize, monitor, and

control the probability and/or impact of unfortunate events or to maximize

the realization of opportunities. Risks can come from uncertainty in financial

markets, threats from project failures (at any phase in design, development,

production, or sustainment life-cycles), legal liabilities, credit risk,

accidents, natural causes and disasters as well as

deliberate attack from an adversary, or events of uncertain or

unpredictable root-cause.

The International Organization for Standardization

identifies the following principles of risk management:

Risk management should:

·

create value –

resources expended to mitigate risk should be less than the consequence of

inaction, or (as in value engineering), the gain

should exceed the pain

·

be an integral part of organizational processes

·

be part of decision making process

·

explicitly

address uncertainty and assumptions

·

be

systematic and structured process

·

be based on the best available information

·

be

tailorable

·

take human

factors into account

·

be

transparent and inclusive

·

be dynamic, iterative and responsive to change

·

be capable of continual improvement and

enhancement

·

be continually or periodically re-assessed

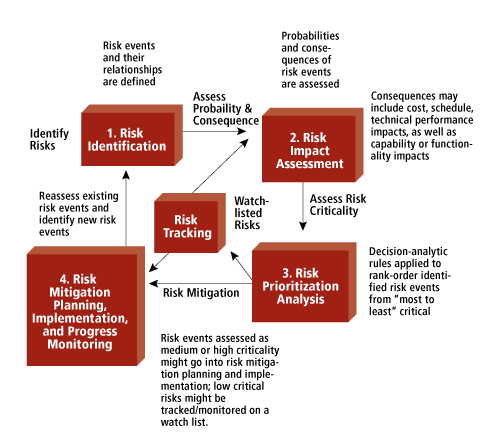

Figure 1. Fundamental Steps of

Risk Management

Step 1. Risk

Identification. Risk identification is the critical first step of the risk management

process. Its objective is the early and continuous identification of risks,

including those within and external to the engineering system project.

Step 2. Risk

Impact or Consequence Assessment. In this step, an assessment is made of the

impact each risk event could have on the engineering system project. Typically,

this includes how the event could impact cost, schedule, or technical

performance objectives. Impacts are not limited to only these criteria.

Additional criteria such as political or economic consequences may also require

consideration. In addition, an assessment is made of the probability (chance)

each risk event will occur.

Step 3. Risk

Prioritization. At this step, the overall set of identified risk events, their

impact assessments, and their occurrence probabilities are

"processed" to derive a most critical to least critical rank-order of

identified risks. A major purpose for prioritizing risks is to form a basis for

allocating critical resources.

Step 4. Risk

Mitigation Planning. This step involves the development of mitigation plans

designed to manage, eliminate, or reduce risk to an acceptable level. Once a

plan is implemented, it is continually monitored to assess its efficacy with

the intent to revise the course-of-action, if needed.

Literature

1.

International Organization for Standardization (ISO)/International

Electrotechnical Commission (IEC), ISO/IEC Guide 73, Risk Management VocabularyGuidelines.http://www.iso.org/iso/catalogue_detail.htm?csnumber=44651

2.

Risk-management http://en.wikipedia.org/wiki/Risk_management

#cite_note-iso3100-5

3.

Risk-management

http://www.mitre.org/publications/systems-engineering-guide/acquisition-systems-engineering/risk-management