Law/9. Civil law

Asel Kenzhetayeva, magister

Zhetysu State

University named after I. Zhansugurov, Taldykorgan, Republic of Kazakhstan

THE

LEGAL NATURE OF A BILL OF EXCHANGE AS AN NEGOTIABLE INSTRUMNET

Supervisor - Phd in Law, Y.Sh .Dussipov

One

of the most actual issues today relate to a bill of exchange. The concern of

this research is to examine peculiarities of the bill of exchange throughout

its history and figure out the legal nature of the bill of exchange as an

negotiable instrument. Before starting our research it would be better to

clarify what the bill of exchange is. In accordance with legislative acts there

are a number of definitions towards the term, like for instance, “Bill of

exchange is defined as an unconditional order in writing, signed by the drawer

addressed to another, directing him to

pay to a third party a specified sum of money on demand or at a future time.” [1,

56]

Another

one says that “Bills of exchange are

negotiable instruments incorporating an unconditional order, addressed by one

person to another, signed by the person giving it, requiring the person to whom

it is addressed to pay on demand or at a fixed or determinable future time a

certain sum in money to or to the order of a specified person.” [2, 86]

From

this we can see that bill of exchange is an instrument which has unconditional

order to pay a certain sum money, the time of

payment, the place of payment, the name of the person who is to pay (drawee),

the name of the person to whom or to whose order payment is made, the date when

and the place where the bill is issued, the signature of the person who issues

the bill (drawer). Now it

would be significant to investigate history of legal regulation of the bill of exchange.

Having analyzed different materials, we came to know that the bill of exchange

is ancient practice, which takes its origin from Italy in the 12th and 13th centuries. “Italy, in that period,

was considered to be the centre of trade in Europe. The merchants throughout

Europe came in contact with the Italian Lombards, through whom negotiable

instrument bills of exchange in their present form were introduced to Europe.

The implications of negotiable instruments remained relatively constant

throughout Europe, until the end of the 17th and the beginning of the 18th centuries. Thus far, the practice relating to negotiable

instruments on both sides of the Channel was, due to the common origin from

which negotiable instruments evolved, as well as the trade exchange,

substantially similar. Since the 17th and 18th centuries, the essential

characteristics of negotiable instruments have witnessed variant treatment.

These differences became more apparent at the beginning of the 19th century

when, incidentally, the practice of negotiable instruments was incorporated in

special codifications. The major codification in the Anglo-American group is

English Bills of Exchange Act (1882) B.E.A. The influence of the B.E.A. was not

confined to English legal system. Rather, it travelled across the Atlantic and

beyond the Continent. Canada and the Commonwealth countries adopted the B.E.A.

wholly or partly. In the United States, the B.E.A. has also been consulted.”

“At present, the major codifications of the law of

negotiable instruments could be divided into two groups, namely the Anglo-American

and the Continental Geneva legal groups. The main codification of the latter

group is the Geneva Conventions of 1930 and 1931.”[1, 20] “In 1930, the

committee convened a conference to discuss the experts' draft convention.

However, it was decided that the conference should discuss the unification of

laws relation to bills, notes and cheques in two separate sessions. The 1930

session was concerned with bills of exchange and promissory notes. The 1931

session was, by comparison, concerned with cheques. Both sessions were held in

Geneva.”[1, 21]

“Two types of documents could, in the light of the

foregoing application, qualify as negotiable instruments, viz. “documents of title” and “money documents”. Examples of the

former are the bill of lading and warehouse receipts. Examples of the money

document are bills of exchange, share certificates and treasury bills. If we

take the money document, it incorporates a monetary obligation. The issuer of

the document promises to pay to the third party specified sum of money or

arranges with another that payment of the specified sum of money shall be made

in favour of a third party.” [1,36]

Moving on, it would be necessary to note that securities have long

living history, where appears the term “Scripophily”. So actually “scripophily, the collecting of old stocks and bonds,

gained recognition as a hobby around 1970. The word "scripophily"

was coined by combining words from English and Greek. The word "scrip" represents an ownership

right and the word "philos" means to love. Today, there are thousands

of collectors worldwide (Scripophilists) in search of scarce, rare, and popular

stocks and bonds. Collectors who come from a variety of businesses enjoy this

as a hobby, although there are many who also consider scripophily a good investment.

In fact, over the past several years, the hobby has exploded in popularity. A

large part of scripophily is the area of financial history. Over the years

there have been millions of companies which needed to raise money for their

business. In order to do so, the founders of these companies

issued securities.” [3] (see figure-1.)

The bill of exchange is considered to be security which is the negotiable

instrument in other hand. As the negotiable instrument

bills of exchange have a few clear benefits in market economy to discuss about,

except being part of history. “Companies have used

Bills of Exchange for hundreds of years. Their longevity is due to the

advantages they provide in trading transaction.

- Bill of Exchange facilitates the granting of

trade credit to a buyer.

- Bill of Exchange provides a legal acknowledgement

that a debt exists.

- It can provide a seller with access to financing.

- It can provide easy access to legal systems in

the event of non-payment.” [4]

We

should consider the arguments mentioned above, and let us turn our attention to

“the following are the advantages of bill of exchange:

1. It is legal evidence of debt.

2. It is a convenient method for the transfer of debt

3. A creditor can sue on the bill itself

4. It is the negotiable instrument and can be transferred for the

settlement of one's debt without difficulty.

5. It can be cashed before due date by discounting.

6. A debtor enjoys the benefit of full period of credit.

7. It affords an ease means of transmitting money from one place to

another.

It is for the aforesaid advantage, a

buyer can easily be included to purchase goods and accept bills drawn on him by

the seller when he is not prepared to pay cash at the time of purchase.” [5]

Due to the growing tendency of information technology the

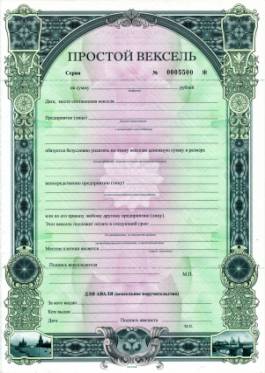

bill of exchange is changing its format (see figure 2 and 3). And “it is

necessary for negotiable instruments in the form of bills of exchange and

promissory notes have to preserve their expediency in international trade in

the modern day. They must be recognised in a valid electronic format. These

electronic instruments should be capable of satisfying legal requirements which

are set out in various statutory provisions and different jurisdictions.”[6]

From the foregoing, it could be concluded that the

bill of exchange as the negotiable instrument plays a great role in market

economy development of every country. And it is known as the security in many

European countries, but there are some governments, where the bill of exchange

is not deemed to be securities, but means of payment. Like for instance, if we consult with the Republic of Kazakhstan

Law on payments and remittances it notes that “A Bill of Exchange is application

of bills of exchange as a method of payment shall be governed by laws of the

Republic of Kazakhstan on circulation of notes.”[7] Thus, the bill of exchange

has two characteristics, which means being security and method of payment. Since

shaping an efficient market deals with the introduction of an efficient finance

instrument, here arises the monetary obligations which should be regulated by

law.

Appendix

|

Figure1. securities of the last century |

|

Figure 2. bill of exchange paper format

|

Figure3. paperless

format of bill of exchange

|

|

|

|

|

|

|||

|

|

|||||||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

|

|||

|

|

Pay

this Bill of Exchange |

||||||

|

|

|

|

|

|

|||

|

To the

order of |

|

||||||

|

|

|

|

|

|

|||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

|

|||

|

|||||||

|

|

|

|

|

|

|||

|

|

|||||||

|

|

|||||||

Reference:

1.

Alsulaimi, Zaki (1990) The risk of the forgery of signatures and

the problem of conflicting entitlements in the law of negotiable instruments: a comparative study, Durham

theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/6527/

2.

Fasil Alemayehu,

Merhatbeb Teklemedhin, Law of Banking,

Negotiable Instruments and Insurance Teaching Material, Sponsored by the Justice and Legal System

Research Institute, 2009

3.

http://en.wikipedia.org/wiki/Scripophily

[Accessed: 9th March 2014].

4.

http://www.aibtradefinance.com/tf/frontBOEPage5.asp [Accessed: 8th March 2014].

5.

http://www.accounting4management.com/advantages_of_bill_of_exchange.htm [Accessed: 7th March 2014].

6.

http://www.lawteacher.net/tort-law/essays/principle-of-negotiability-of-negotiable-instruments.php [Accessed: 6th March 2014].

7.

Law of the Republic of Kazakhstan

dated June 29, 1998 N 237 concerning

payments and remittances

8.

Figure 1. http://aveksel.narod.ru [Accessed:

9th 8th March]. [Accessed: 1st March

2014].

9.

Figure 2. http://aveksel.narod.ru/zel_14.html[Accessed:

9th March 2014].

10. Figure 3. http://www.aibtradefinance.com/tf/BillofExchange.asp

[Accessed: 10th March 2014].