Economic sciences / 10.Enterprise Economy

PG

student Buz O.O.

Odessa National Academy of

Telecommunications named after A. S. Popov,

Ukraine

Simulation

modeling of calculation the net present value (NPV) of the assimilation of LTE

− technologies in Ukraine

In the modern conditions of

economic management the essential element of effective development of the

enterprise telecommunications sector is the assimilation of LTE −

technologies in Ukraine in order to improve the quality of services and the

overall competitiveness of enterprises. Therefore,

the great importance is the cost-benefit analysis of the project, the impact of

innovations on the financial performance of companies, identification of risks,

costs and benefits obtained through the introduction of new technologies.

For an innovative project realization by the mobile

operator to draft the assimilation of LTE − technologies by Ukrainian

telecommunications companies. For construction 4G LTE − networks is used the basic

stations used by Company Huawei. The price range of one such antenna

comprises 1150 UAH per unit. While investing in the project 800000,00 UAH for the

purchase of 4,000 such antenna systems, payback period of the project will be

near 5 years at a discount rate of 10 %, where was represented the model

calculation of the net present value NPV. For simplicity of solution let’s assume

that all cash flows are generated at the end of the year. The using the value of the expectation values

can estimate the most probable value of the net discounted cash flow and net

expected value of the project in a specified model. Also, defining the standard error can

estimate the deviation estimates of expected values of the parameters. Standard deviation to determine the

intervals of variation values NPV [1, 2].

To calculate the net present value

NPV criterion was developed software simulation model in C ++ Builder

environment 6, which shows the project cash flows. The

results of a series of experiments with a simulation model for calculating the

net present value of the project for the implementation of 4 G LTE

− technologies displayed in Fig. 1.1.

Fig. 1. 1. Model calculation of the net present value (NPV) at a discount

rate of 0,7 %.

Fig. 1. 1. Shows the changes in the expected present value of the

investment project for the period. The

primary investment project or part of 800000,00 UAH at a discount rate of 0,7

%. The first year of the expected revenue amounted to UAH

88235,30 for the second year this amounted to 60553,63 UAH. On the

chart reflects the expected profit decline for the third period and the end of

the fifth period of this amount was 26939,33 UAH. Therefore at the

cost of investing in the project posted on rum 800000,00 UAH received income

was 229113,91 UAH for a period of 5 years. Model calculate

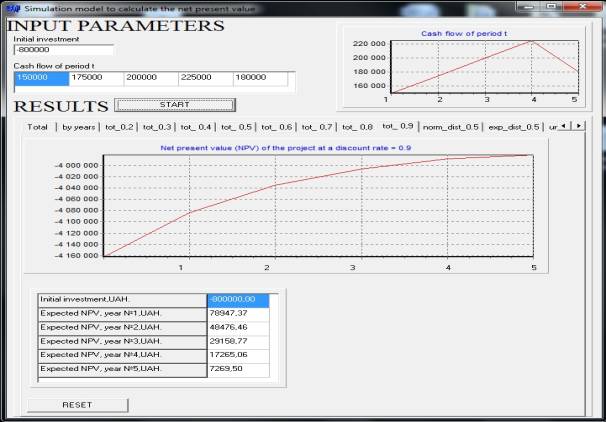

the net present value at a discount rate of 0,9 % and reflected in Fig. 1. 2.

Fig. 1. 2. Model calculation of the net

present value (NPV) at a discount rate of 0, 9 %.

Fig. 1. 2

shows the distribution (NPV), depending on the discount rate of 0.9%. The greatest amount of expected income falls on the

first year immediately after deductions investment in the project and is

78947,37 UAH. Since the third period, the amount significantly decreased and at the end of the fifth

period amounted to UAH 7269,5 0.

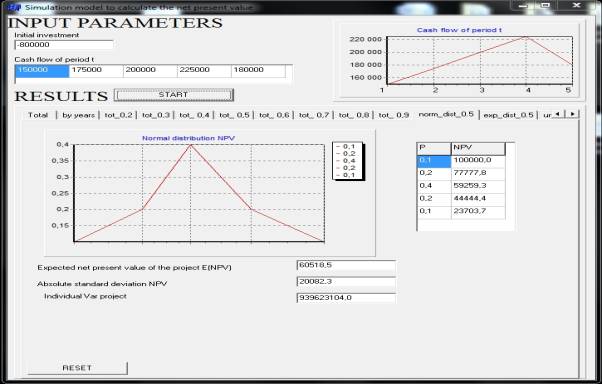

Graph of the function of the normal

distribution is determined by the normal curve or Gaussian curve. An

important property of the differential graph of normal distribution functions

is its limited area a normal curve and the x axis, which is always equal to 1,

shown in Fig. 1. 3.

However, after analyzing the amount

of damages and profits for innovative projects that can separate what the

expected net present damage is E (NPV) = 60518,5 UAH, and the expected present

value of EL = 182127,17 UAH with deviations of the project. This amount refers

to positive net present value and shows how to grow the value of invested

capital as a result of the project.

Fig. 1. 3. Calculation of NPV

criterion for a normal distribution.

Thus, the rate of NPV > 0, which

means that the project is profitable for the investor and the enterprise as a

whole. It follows that the damage is minor compared to

revenues that can get mobile operators of Ukraine from the introduction of

technology LTE. In general, analyzing the resulting calculations

should be noted that the specific value is a special case and reliability

necessary to conduct a series of experiments with the model.

References

1.

Pioneering 4G networks. Telia Sonera provides Schenker

AB with 4G and cloud services/ [Electronic resource]: http.://www.teliasonera.com/en/innovation

/access-is-king/2011/4/pioneering-4g-networks/

2.

The Real-Time Cloud combines the cloud, Network

Functions Virtualization (NFV) and software-defined networking (SDN) into a new

business proposition for operators. Cloud evolution / [Electronic

resource]: http.://www.ericsson.com/ua/spotlight/cloud-evolution